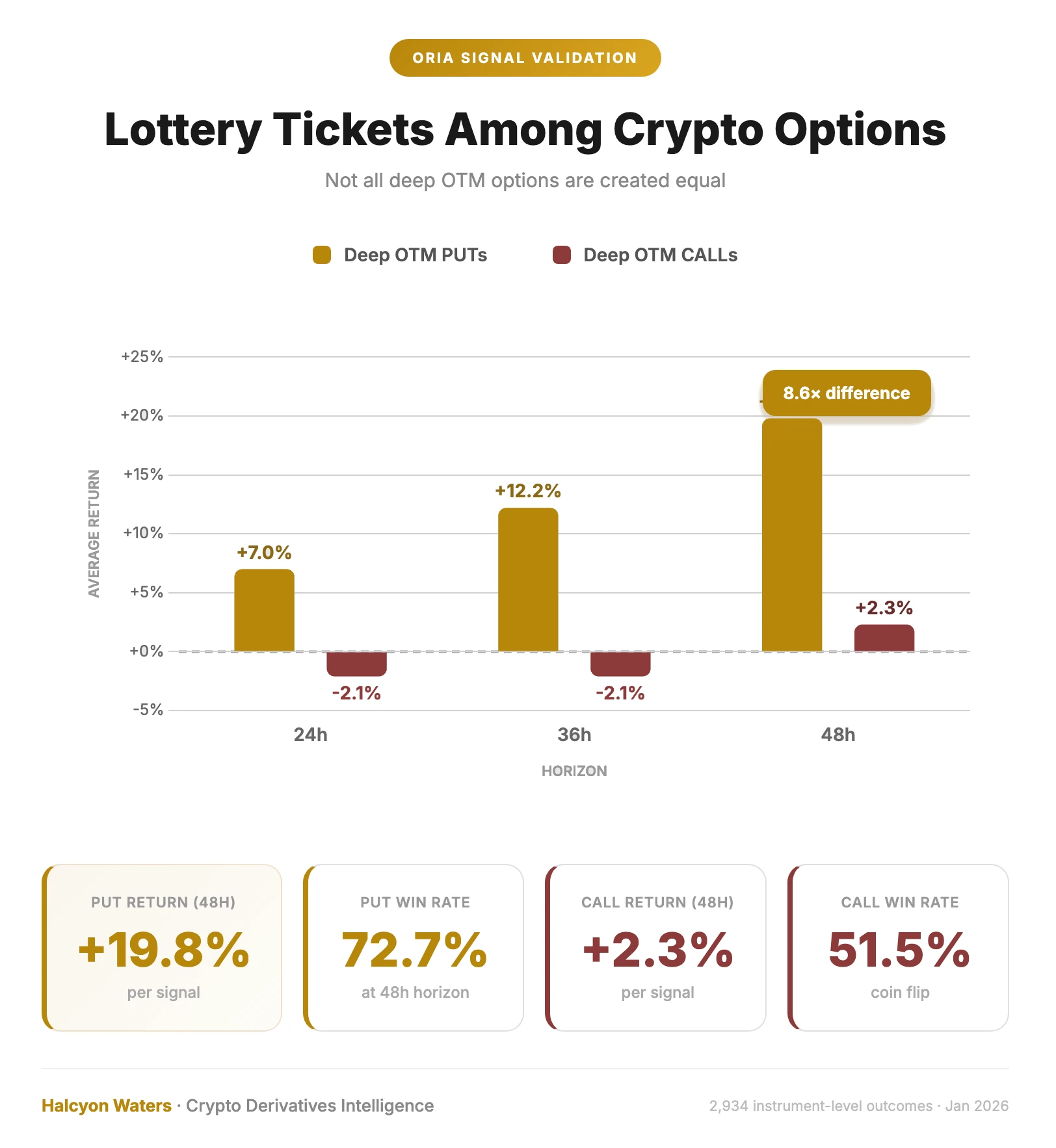

The Lottery Ticket Nobody Talks About: 73% Hit Rate on Deep OTM Puts

We validated 2,934 instrument-level outcomes from ORIA signals. Deep OTM puts hit 72.7% at 48h with +19.8% returns. Calls? Coin flip at 51.5%. Same signal, 8.6x difference in outcomes.

Deep out-of-the-money options are the casino of derivatives trading. Cheap premium, asymmetric payoff, and most expire worthless.

But not all of them.

We validated 2,934 instrument-level outcomes from Cayo Largo's ORIA, our options flow detection system. It flags unusual activity in Deribit BTC and ETH options: whale accumulation, abnormal volume clusters, aggressive positioning.

When these signals pointed to deep OTM puts:

72.7% win rate at 48h horizon. +19.8% average return per signal. Performance improved with time (see chart).

When the same signals pointed to deep OTM calls:

51.5% win rate, statistically no better than random. +2.3% average return. Flat across all horizons.

Same moneyness bucket. Same detection logic. 8.6x difference in outcomes.

Our interpretation: institutional flow into cheap puts often signals informed hedging. Someone knows something.

The signal is the same. What it catches is completely different.

Halcyon Waters: Your Calmness Among Crypto Chaos