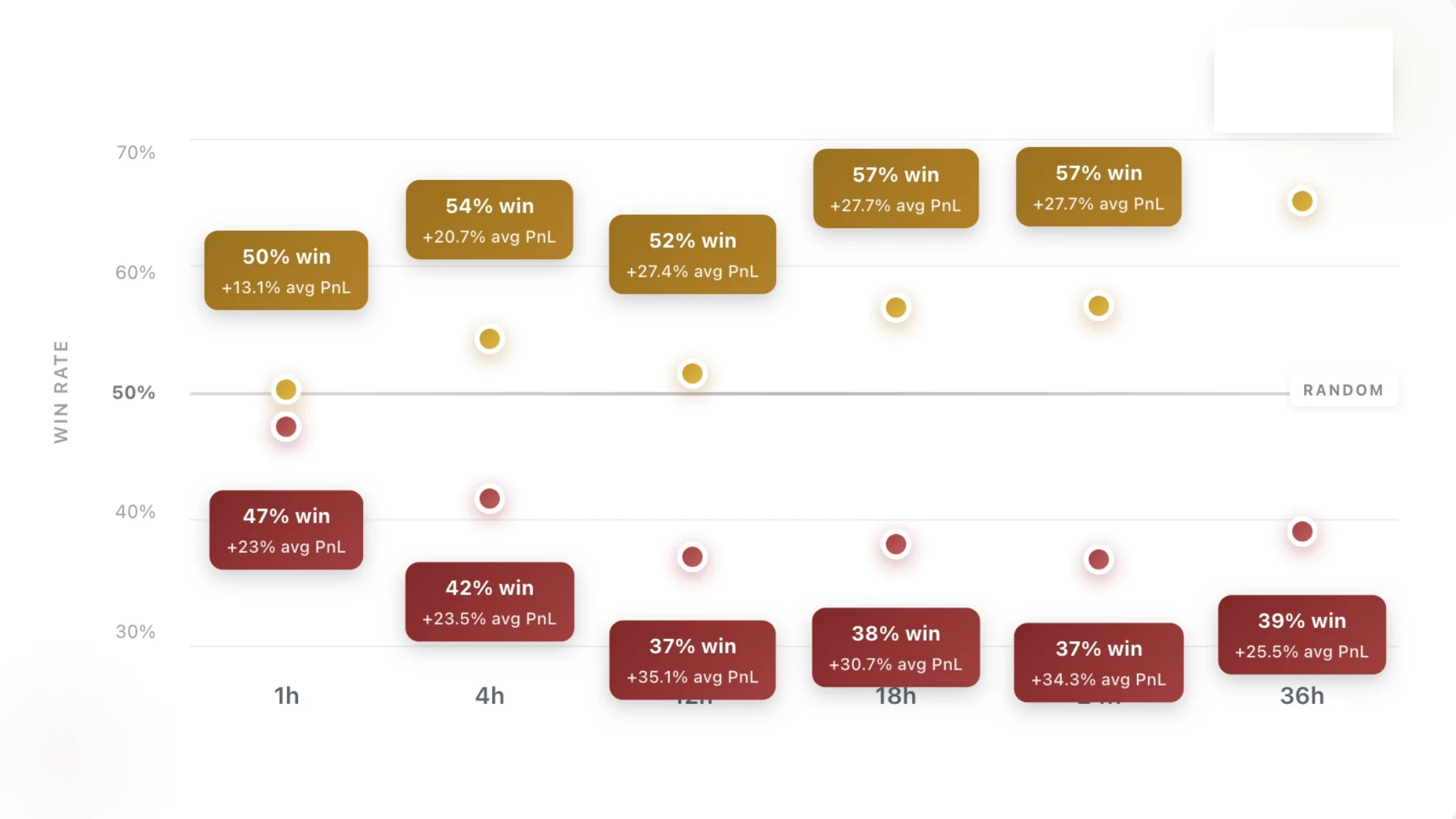

The Lottery Ticket Nobody Talks About: 73% Hit Rate on Deep OTM Puts

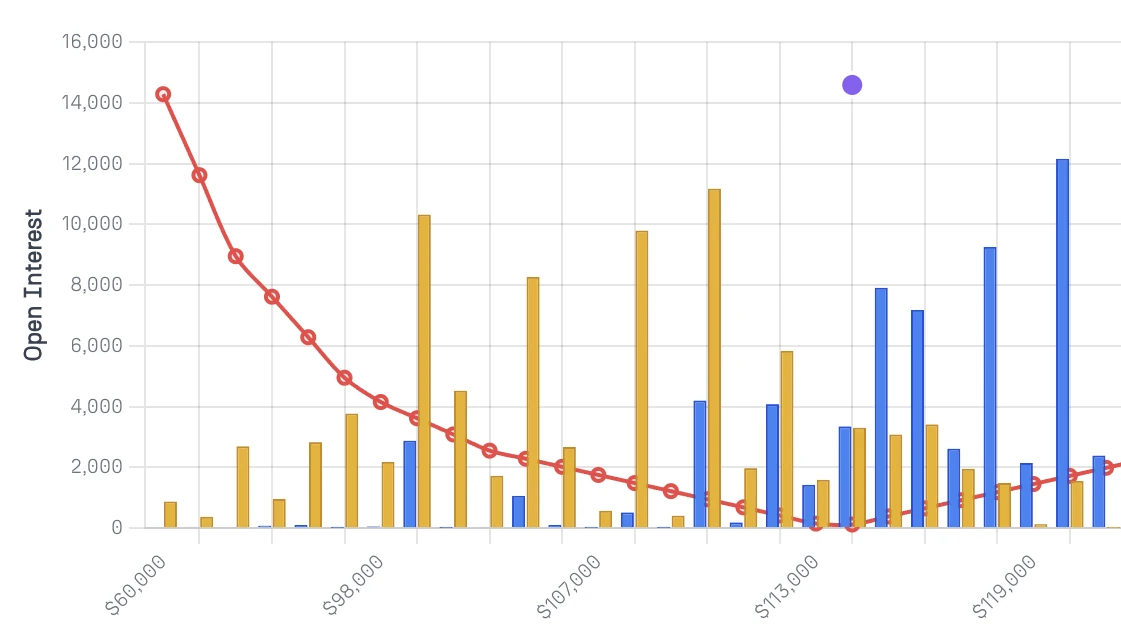

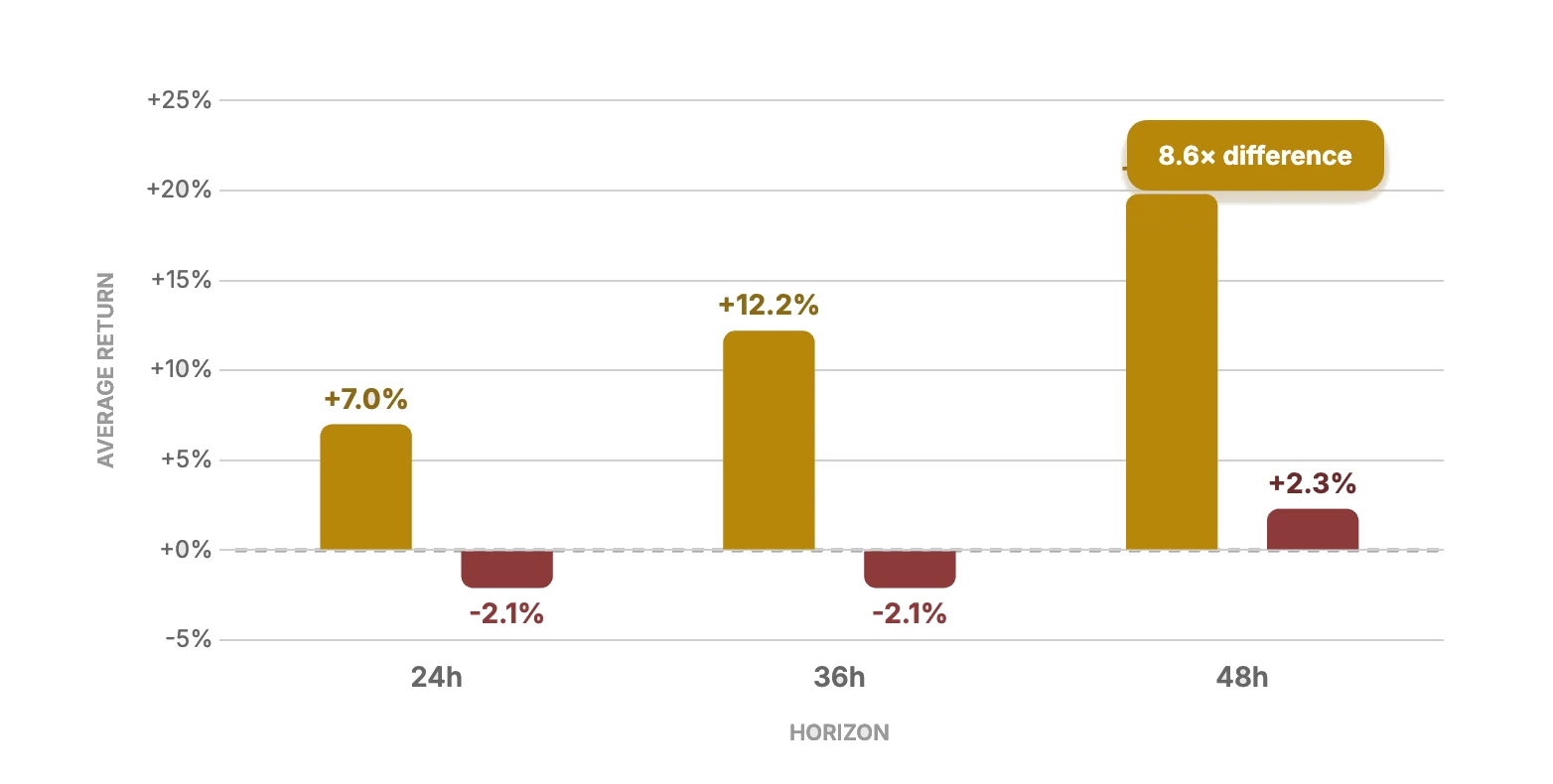

We validated 2,934 instrument-level outcomes from ORIA signals. Deep OTM puts hit 72.7% at 48h with +19.8% returns. Calls? Coin flip at 51.5%. Same signal, 8.6x difference in outcomes.