BTC vs ETH Options: The Execution Quality Revolution - Why Both Markets Just Got Much Better

Our upgraded comprehensive analysis reveals a dramatic transformation in crypto options execution quality. Both Bitcoin and Ethereum options now offer significantly tighter spreads and more efficient trading opportunities, though ETH maintains its execution advantage.

"When execution costs drop dramatically, entirely new trading strategies become profitable."

The crypto options landscape has undergone a quiet revolution. Our latest comprehensive analysis of Bitcoin and Ethereum options execution quality reveals improvements so significant they fundamentally change what's possible for options traders in crypto markets.

Where we previously saw punishing bid-ask spreads that could eliminate even theoretically profitable strategies, we now find execution environments that rival many traditional markets. This isn't a minor incremental improvement. It's a structural transformation that opens entirely new strategic possibilities.

The story becomes even more compelling when you examine how this improvement is distributed between Bitcoin and Ethereum options. While both assets show remarkable progress, the execution quality gap between them tells us something important about market evolution and where the most efficient opportunities lie.

The Execution Quality Revolution

Understanding the magnitude of this change requires context. In options trading, bid-ask spreads represent the unavoidable tax you pay to market makers for providing liquidity. When these spreads are wide, they can overwhelm the edge from even sophisticated strategies. When they tighten dramatically, strategies that were previously impossible become not just viable but potentially profitable.

Our system now captures execution quality across a much broader spectrum of strikes and conditions, revealing improvements that weren't visible in previous analysis frameworks. The results suggest crypto options markets have reached a new level of institutional sophistication.

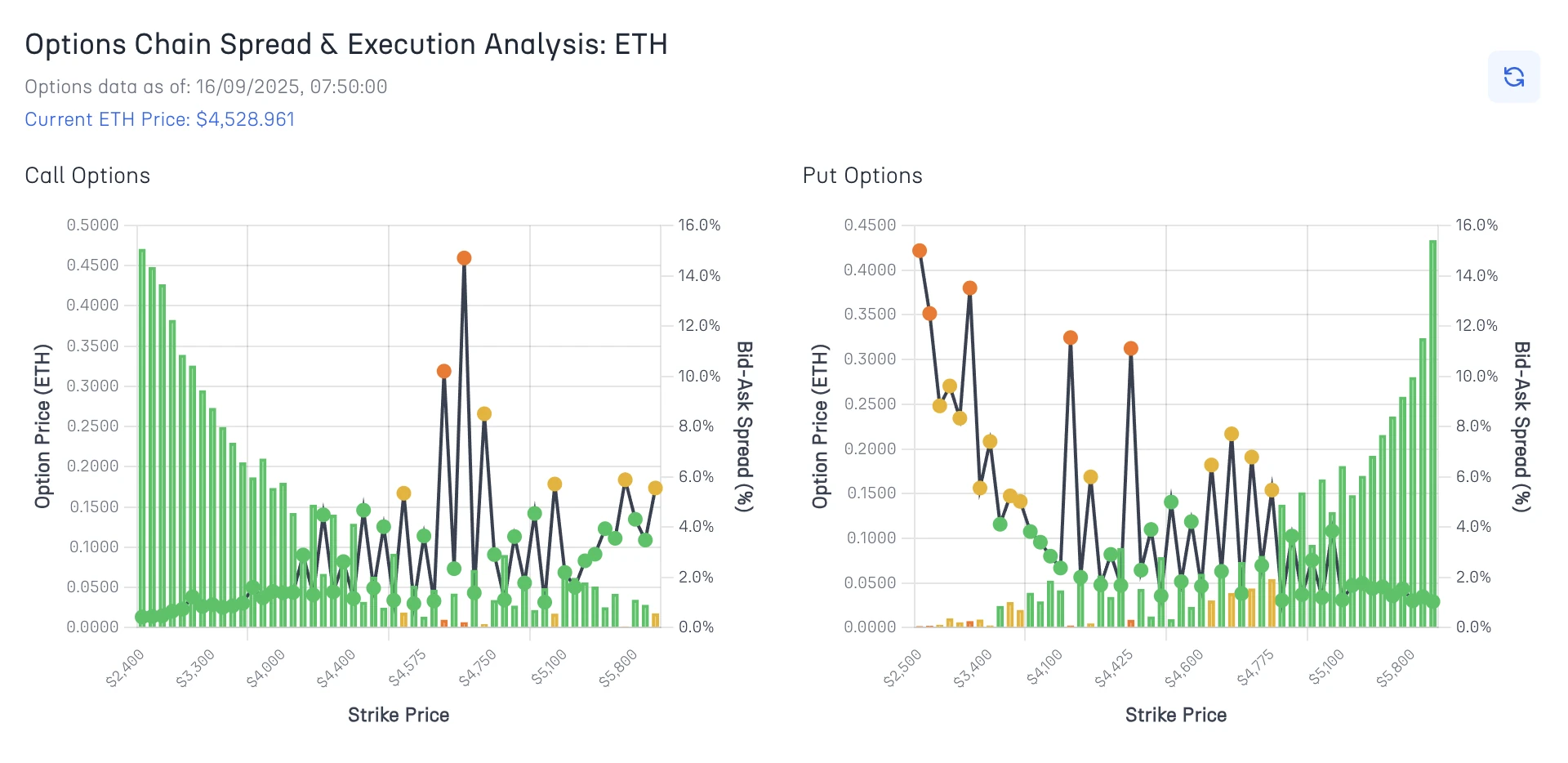

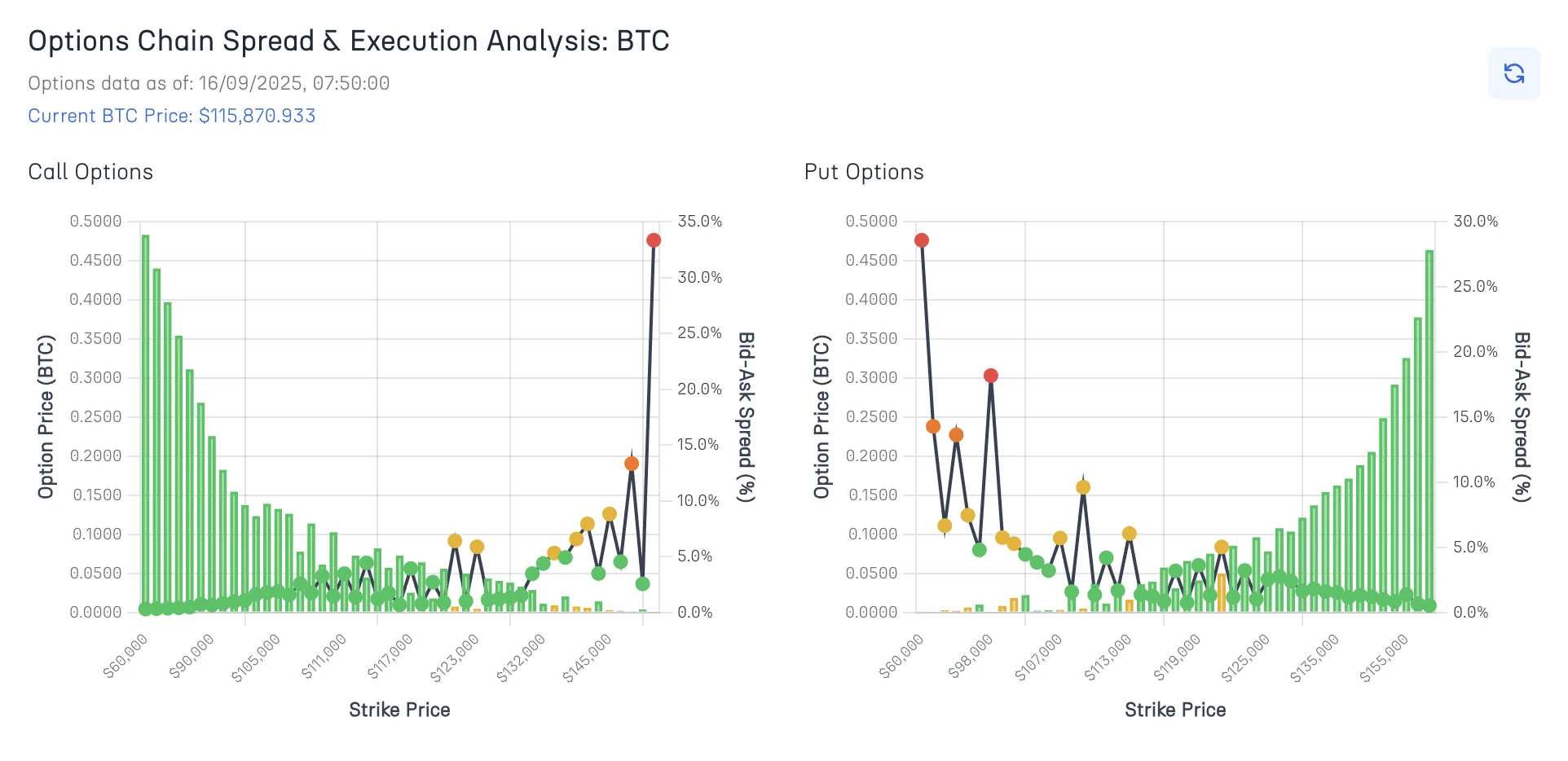

Figure 1: BTC Options Execution Analysis - Revolutionary improvement with tight spreads across most strikes

Bitcoin Options: Dramatic Improvement Story

Bitcoin options trading at $115,871 now present an execution landscape that would have seemed impossible just months ago. Average spreads have compressed to just 3.4% for calls and 4.3% for puts representing a dramatic tightening from previous levels that often exceeded 9-11% a year ago.

Even more impressive is the distribution of execution quality across the options chain. Bitcoin now offers 39 strikes with excellent execution conditions for calls and 33 for puts. The punitive execution zones that previously plagued Bitcoin options trading have nearly disappeared, with only 1 problematic call strike and 2 problematic put strikes remaining.

This transformation means Bitcoin options traders now have vastly more strategic flexibility. Multi-leg strategies that were previously prohibitively expensive due to execution costs are now economically viable. Calendar spreads, iron condors, and other complex strategies can be implemented without worrying that bid-ask spreads will overwhelm the theoretical edge.

The overall 7.4% average spread across all Bitcoin options represents a new benchmark for crypto options efficiency. More importantly, the concentration of excellent execution opportunities around actively traded strikes means most practical trading occurs in highly efficient zones.

Ethereum Options: Leading the Efficiency Race

Ethereum options at $4,529 demonstrate why this market continues to set the standard for crypto options execution quality. With average spreads of just 2.8% for calls and 4.3% for puts, ETH options now approach the execution efficiency of many traditional equity options.

The distribution tells an even more compelling story. Ethereum offers 45 strikes with excellent execution conditions for calls and 35 for puts, significantly outpacing Bitcoin's already impressive improvements. Most remarkably, ETH options show zero punitive execution zones for both calls and puts—a complete elimination of the execution traps that can destroy trading profitability.

This 6.0% overall average spread, combined with the broad distribution of efficient strikes, creates an environment where sophisticated options strategies can be implemented with confidence that execution costs won't undermine theoretical advantages. The absence of problematic execution zones means traders can focus on strategy optimization rather than navigating around market inefficiencies.

The green zones extending across ETH's options chain represent more than just lower costs—they indicate a depth of market making activity that supports position adjustments, strategy modifications, and tactical responses to changing market conditions.

The Numbers Reveal a Market Transformation

Comparing current execution metrics to previous analyses we did, now it reveals the scope of this transformation. Bitcoin's improvement from double-digit average spreads to 3.4-4.3% represents a fundamental shift in market structure. Ethereum's advancement to sub-3% call spreads places it in competition with established traditional markets.

The dramatic increase in excellent execution opportunities, from handfuls of efficient strikes to dozens, indicates that market makers are now actively competing across much broader ranges of the options chain.

Perhaps most significantly, the virtual elimination of punitive execution zones suggests that market making algorithms have become simply better to provide reasonable liquidity even in previously neglected areas of the options chain. This creates a more predictable and navigable trading environment.

The quality distribution improvements also reflect increased institutional participation. When institutional traders demand efficient execution across multiple strikes for complex strategies, market makers respond by enhancing their coverage and competitiveness.

Experience the execution quality revolution firsthand

Access real-time execution quality monitoring across BTC, ETH, SOL, and XRP options at cayolargo.fi/options-chain-spread featuring comprehensive spread analysis and strike efficiency optimization.

The Cayo Largo execution intelligence system now provides enhanced comprehensive analysis that reveals the full spectrum of trading opportunities, helping traders capitalize on the execution quality revolution transforming crypto options markets.

Frequently Asked Questions

How much have crypto options execution costs improved?

Bitcoin options now show average spreads of just 3.4% for calls and 4.3% for puts, down from previous levels above 9-11%. Ethereum options are even tighter at 2.8% calls and 4.3% puts, creating a much more efficient trading environment.

Why do ETH options still outperform BTC options in execution quality?

ETH options show zero punitive execution zones for both calls and puts, compared to BTC's minimal 1-2 problem areas. ETH also offers 45 excellent calls versus BTC's 39, demonstrating deeper liquidity across more strikes.

What caused this dramatic improvement in options execution quality?

The improvements likely reflect enhanced market making activity, increased institutional participation, and technological upgrades that enable more competitive pricing across broader strike ranges.

Are crypto options now competitive with traditional markets in execution quality?

The current 2.8-4.3% average spreads represent a significant step toward traditional market efficiency, though crypto options still typically carry higher transaction costs than major equity or index options.

Related Articles

Why Every Options Trader Needs Two IV Curves and Most Only See One?!

Traditional IV curves show elegant mathematical beauty but hide execution reality. Our Enhanced IV Term Structure Intelligence reveals what happens when you trade those curves – introducing dual-line analysis that separates market fiction from volume-weighted reality, transforming options education and professional trading alike.

Reading the Storm: How BTC Options Volume Heatmaps Predicted the $115K Breakout

A real-time case study showing how options volume heatmap analysis correctly predicted Bitcoin's explosive move from $114K to $115K, and why the subsequent put activity reveals sophisticated institutional positioning rather than bearish sentiment.