Bitcoin Gamma Walls: When Math Meets Market Reality

We dive into Bitcoin options gamma exposure which reveals a surprising disconnect between theory and practice. With aggregate GEX representing just 0.03% of daily trading volume, are 'gamma walls' actually walls or just speed bumps?

Bitcoin options expiry at Deribit exchange on Fridays. Over $17 billion notional rolling off Deribit today. The Internet buzzes with gamma wall charts and max pain predictions. Everyone's talking about the inevitable pin to $114k where maximum option seller profit lies.

But when you actually run the numbers, we mean you really run them with a proper methodology and market context then something unexpected emerges. Here is the story as observed on Thursday's afternoon, 2025-09-25, -1 day to options' expiry.

The Numbers That Don't Add Up

Gamma Exposure, , measures the dollar amount that market makers need to hedge when Bitcoin's price moves. The mathematical relationship is straightforward:

Where represents the rate of change of delta with respect to the underlying price, is the open interest, and is the current spot price.

We use the linear version rather than the quadratic formula that squares the underlying price. Reason? We're measuring actual hedging flow, not theoretical convexity. When Bitcoin moves one dollar, market makers need to trade gamma times open interest times one dollar worth of delta.

To understand why this matters, recall that itself is defined as:

This second derivative of the option value with respect to spot price tells us how quickly delta changes as the underlying moves. Sounds easy, right? Since delta is:

we can see that gamma measures the acceleration of option's sensitivity to price changes, not just the speed.

Let's pull some real market data from our Cayø Largo database where every 10 min we crunch Deribit's options tectonics and track every single option with sufficient reliability and liquidity:

-- BTC Aggregate Linear GEX Calculation

-- Database: cayølargo-db

WITH latest_options_data AS (

SELECT DISTINCT ON (md.instrument_id)

md.instrument_id,

bg.instrument_name,

md.underlying_price,

md.open_interest,

bg.gamma,

bg.strike,

bg.option_type,

bg.days_to_expiry,

bg.reliability_score,

md._timestamp

FROM deribit_options_marketdata md

INNER JOIN deribit_options_blackscholes_greeks bg

ON md.instrument_id = bg.instrument_id

AND md._timestamp = bg._timestamp

WHERE md.coin = 'BTC'

AND md._timestamp >= NOW() - INTERVAL '1 day'

AND md.open_interest > 0

AND bg.gamma IS NOT NULL

AND bg.reliability_score >= 30

AND md.underlying_price IS NOT NULL

AND md.underlying_price > 0

ORDER BY md.instrument_id, md._timestamp DESC

)

SELECT

'BTC' AS coin,

COUNT(*) AS total_options_count,

ROUND((SUM(ABS(gamma * open_interest * underlying_price::numeric)))::numeric, 0) AS aggregate_linear_gex,

ROUND((SUM(gamma * open_interest * underlying_price::numeric))::numeric, 0) AS net_linear_gex,

ROUND((AVG(underlying_price))::numeric, 2) AS avg_underlying_price,

ROUND((SUM(open_interest))::numeric, 2) AS total_open_interest,

MAX(_timestamp) AS data_timestamp,

-- Breakdown by option type

ROUND((SUM(CASE WHEN option_type = 'call' THEN ABS(gamma * open_interest * underlying_price::numeric) ELSE 0 END))::numeric, 0) AS calls_linear_gex,

ROUND((SUM(CASE WHEN option_type = 'put' THEN ABS(gamma * open_interest * underlying_price::numeric) ELSE 0 END))::numeric, 0) AS puts_linear_gex,

-- Breakdown by expiry

ROUND((SUM(CASE WHEN days_to_expiry <= 7 THEN ABS(gamma * open_interest * underlying_price::numeric) ELSE 0 END))::numeric, 0) AS weekly_linear_gex,

ROUND((SUM(CASE WHEN days_to_expiry <= 30 THEN ABS(gamma * open_interest * underlying_price::numeric) ELSE 0 END))::numeric, 0) AS monthly_linear_gex,

-- Formatted result for reporting

CONCAT('$', ROUND((SUM(ABS(gamma * open_interest * underlying_price::numeric)) / 1000)::numeric, 0), 'k') AS formatted_gex

FROM latest_options_data;

The results can stop us cold. Aggregate Bitcoin GEX clocks in at $917,000. Daily BTC options volume runs about $2.5 billion. The critical ratio becomes:

That's not a typo. Total gamma exposure represents less than four one-hundredths of one percent of daily trading activity. In a market where individual whales can move prices with $50 million orders, we're talking about theoretical hedging flows that wouldn't even register on most trading desks!

Why Friday's Expiration Should Matter

Friday's massive expiry creates what should theoretically be maximum gamma pressure. Options with 24-48 hours to expiration have gamma approaching infinity for at-the-money (ATM) strikes. This is when the rubber meets the road for gamma wall theory.

The basic concept is following. When lots of options expire at the same strike price (say $115,000), the market makers who sold those options need to hedge their risk. As Bitcoin's price approaches that level, they're forced to buy or sell Bitcoin to maintain neutral positions.

Options traders believe these hedging flows are so large they can actually push Bitcoin toward certain price levels, especially on expiration days. That's why you see charts showing "gamma wall" at specific strikes where lots of options are concentrated.

The "Wall" effect can be further split into:

- Support Wall: if market makers need to buy Bitcoin as price approaches a strike, their buying creates upward pressure;

- Resistance Wall: if they need to sell Bitcoin, their selling creates downward pressure.

It's an elegant theory that makes intuitive sense until you examine what actually happens during expiration week.

Options traders learned not to hold positions into expiration day! They usually close out two to three days prior in order to avoid assignment risk and the chaos of settlement mechanics. This means those theoretical gamma spikes you see in pricing models don't translate to real hedging pressure when it matters most. Often, by Thursday afternoon, most of them have already exited. What remains is often speculative retail positions and market makers who are already substantially flat.

The Max Pain Methodology Problem

The max pain calculation itself reveals another problem with the popular narrative. Most calculations you see online are fundamentally wrong. They typically find where current intrinsic value equals zero. Essentially it's just the strike closest to current price. That's not max pain! That's just current at-the-money.

True max pain requires testing each potential expiration price and calculating total payouts to option holders across all strikes. Mathematically, we're solving an optimization problem:

where represents potential expiration prices, is the open interest for option , and the payout function depends on option type:

where is the strike price.

-- Max Pain Calculation for Bitcoin's options at Deribit

-- Database: cayølargo-db

WITH latest_options_data AS (

SELECT DISTINCT ON (md.instrument_id)

md.instrument_id,

bg.instrument_name,

md.underlying_price,

md.open_interest,

bg.strike,

bg.option_type,

bg.days_to_expiry,

bg.reliability_score,

md._timestamp

FROM deribit_options_marketdata md

INNER JOIN deribit_options_blackscholes_greeks bg

ON md.instrument_id = bg.instrument_id

AND md._timestamp = bg._timestamp

WHERE md.coin = 'BTC'

AND md._timestamp >= NOW() - INTERVAL '1 day'

AND md.open_interest > 0

AND bg.reliability_score >= 30

AND md.underlying_price IS NOT NULL

AND md.underlying_price > 0

AND bg.days_to_expiry > 0

AND bg.days_to_expiry <= 90

ORDER BY md.instrument_id, md._timestamp DESC

),

-- All potential expiration prices (each strike as potential close)

potential_expiration_prices AS (

SELECT DISTINCT strike as test_price

FROM latest_options_data

WHERE strike BETWEEN 80000 AND 150000 -- Reasonable range around current price

),

-- Calculate total payouts for each potential expiration price

payout_calculation AS (

SELECT

pep.test_price,

-- Call payouts when expiration_price > call_strike

SUM(CASE

WHEN lod.option_type = 'call' AND pep.test_price > lod.strike

THEN lod.open_interest * (pep.test_price - lod.strike)

ELSE 0

END) +

-- Put payouts when expiration_price < put_strike

SUM(CASE

WHEN lod.option_type = 'put' AND pep.test_price < lod.strike

THEN lod.open_interest * (lod.strike - pep.test_price)

ELSE 0

END) as total_payouts

FROM potential_expiration_prices pep

CROSS JOIN latest_options_data lod

GROUP BY pep.test_price

)

-- Find the strike with minimum total payouts (true max pain)

SELECT

ROUND(test_price::numeric, 0) as max_pain_strike,

ROUND(total_payouts::numeric, 0) as min_total_payouts,

(SELECT ROUND(AVG(underlying_price)::numeric, 2) FROM latest_options_data) as current_btc_price,

(SELECT COUNT(*) FROM latest_options_data) as total_options_analyzed

FROM payout_calculation

ORDER BY total_payouts ASC, test_price ASC

LIMIT 1;

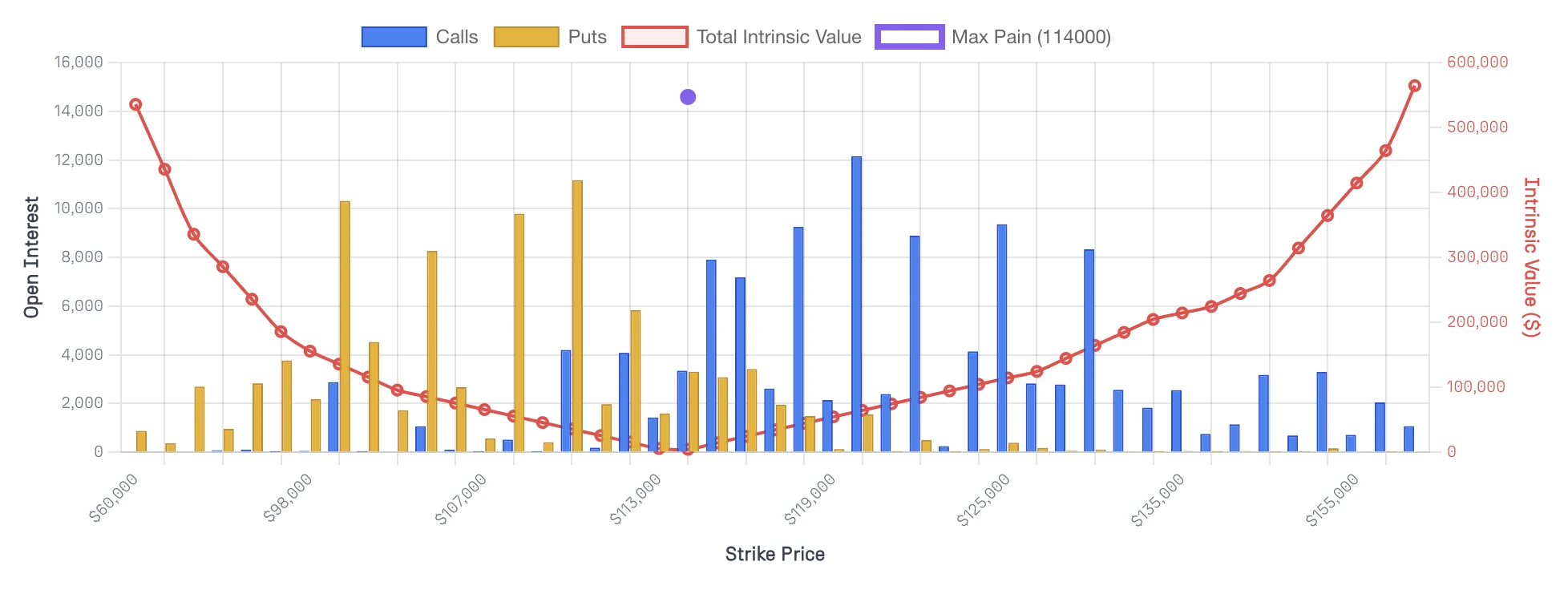

Using this methodology on current data, we find that max pain sits at $114,000 with Bitcoin trading at $111,723. This marks the gap of about $2,277:

Figure 1: Open Interest for BTC as derived one day prior to options expiry key date on 2025-09-26 with derived max pain of $114k based on Deribit's data based on our methodology.

The analysis examined 363 active options positions with total potential payouts of $149 million at the max pain level. But proximity doesn't equal causation, and a $2,277 gap in a market that routinely moves thousands of dollars daily is hardly compelling evidence for gravitational pull.

Surprisingly, our analysis was close to the officially reported by Deribit on the same day (see Figure 2 and 3) with max pain at $110k for BTC. After a closer analysis, we realised the differences in methodologies between Halcyon Waters and Deribit, mainly based on our meticulous options selection process with respect to their quality and liquidity score we have developed in-house:

Figure 3: Original Deribit's options Open Interest distribution chart which we were able to recreate based on our Cayø Largo data collection and processing for BTC: see Figure 1.

The Crypto vs Equity Reality Check

The disconnect becomes clearer when you compare Bitcoin options to equity markets where gamma effects are more established. The structural ratios tell the story:

Similarly, for market capitalization exposure:

This structural difference explains why gamma effects that matter in equity markets become statistical noise in Bitcoin. When SPX options represent 20% of market cap and generate more volume than the underlying shares, market makers' hedging activities can genuinely influence price discovery. When Bitcoin options represent a fraction of a percent of daily spot volume, even perfect gamma wall theory can't overcome the fundamental supply-demand dynamics.

The mechanics of long versus short gamma exposure illustrate why concentration matters more than absolute size. In a long gamma environment, market makers buy dips and sell rallies to maintain delta neutrality. This creates a pinning effect around strike concentrations, suppressing volatility through constant counter-trend flow. You see sideways, range-bound price action that seems inexplicably stable.

Short gamma environments work in reverse. Market makers sell dips and buy rallies, amplifying existing price movements and increasing volatility through pro-trend flow. This can create explosive moves in either direction, as hedging pressure reinforces rather than dampens market moves.

Currently, Bitcoin shows a relatively balanced gamma profile with $451,000 in call exposure versus $466,000 in put exposure. This balance suggests neither strong pinning nor amplification effects, which aligns with our conclusion that gamma impacts remain minimal.

The Gamma Unclenching Phenomenon

One of the most actionable insights from equity options involves what happens after expiration days. When large options positions expire, market makers can unload their hedges, creating what traders call "gamma unclenching." This typically creates low volatility on expiration day itself as positions get pinned, followed by higher volatility in the days immediately following expiration. Potential breakouts from established ranges often emerge during this period.

In Bitcoin, Friday's $17 billion expiry could theoretically create this pattern. The challenge is that small gamma exposure relative to spot trading suggests any effect would be muted. We might see some short-term range compression followed by expansion, but other market forces—institutional flows, technical levels, macro sentiment—likely dominate the aftermath.

The Bottom Line That Matters

Until aggregate gamma exposure exceeds 5-10% of daily trading volume, gamma walls remain more theoretical than practical in Bitcoin markets. Current exposure of 0.037% simply isn't meaningful in the context of actual market forces. This situation might change as options markets mature and open interest grows relative to spot volume, but we're nowhere near that tipping point yet.

Friday's expiration will unfold according to the same forces that drive Bitcoin every day: supply and demand dynamics, institutional flows, technical levels, and macro sentiment. Gamma exposure will be a footnote, not the headline. The real edge comes from understanding what the data actually shows versus what we want it to show. Sometimes the most valuable insight is learning what doesn't matter... :-)

Acknowledgments: to Imran Lakha (x.com/options_insight) for inspiration leading to the research and, eventually, to this article.

Frequently Asked Questions

What is aggregate gamma exposure (GEX) in Bitcoin options?

Aggregate GEX is the total notional dollar exposure that results from market makers hedging their gamma positions across all Bitcoin option strikes. It's calculated as the sum of (|gamma| × open interest × strike price) for all active options.

How significant is current Bitcoin gamma exposure compared to daily volume?

Our analysis shows aggregate BTC GEX of just $0.9 million against $2.5 billion in daily options volume - a ratio of only 0.037%. This suggests gamma effects are economically negligible in the current market structure.

What is max pain in options trading and why does it matter?

Max pain is the strike price where total option holder payouts would be minimized at expiration. It represents the theoretical level where option sellers (usually market makers) would retain the most premium, though its predictive power is debated.

Do gamma walls actually influence Bitcoin price movements?

Based on current exposure levels, gamma walls appear to be more theoretical than practical. With total GEX representing less than 1% of daily trading activity, other market forces likely dominate price discovery.