When Your Signals Actually Predict Something: BULLISH Hits 65% at 36h

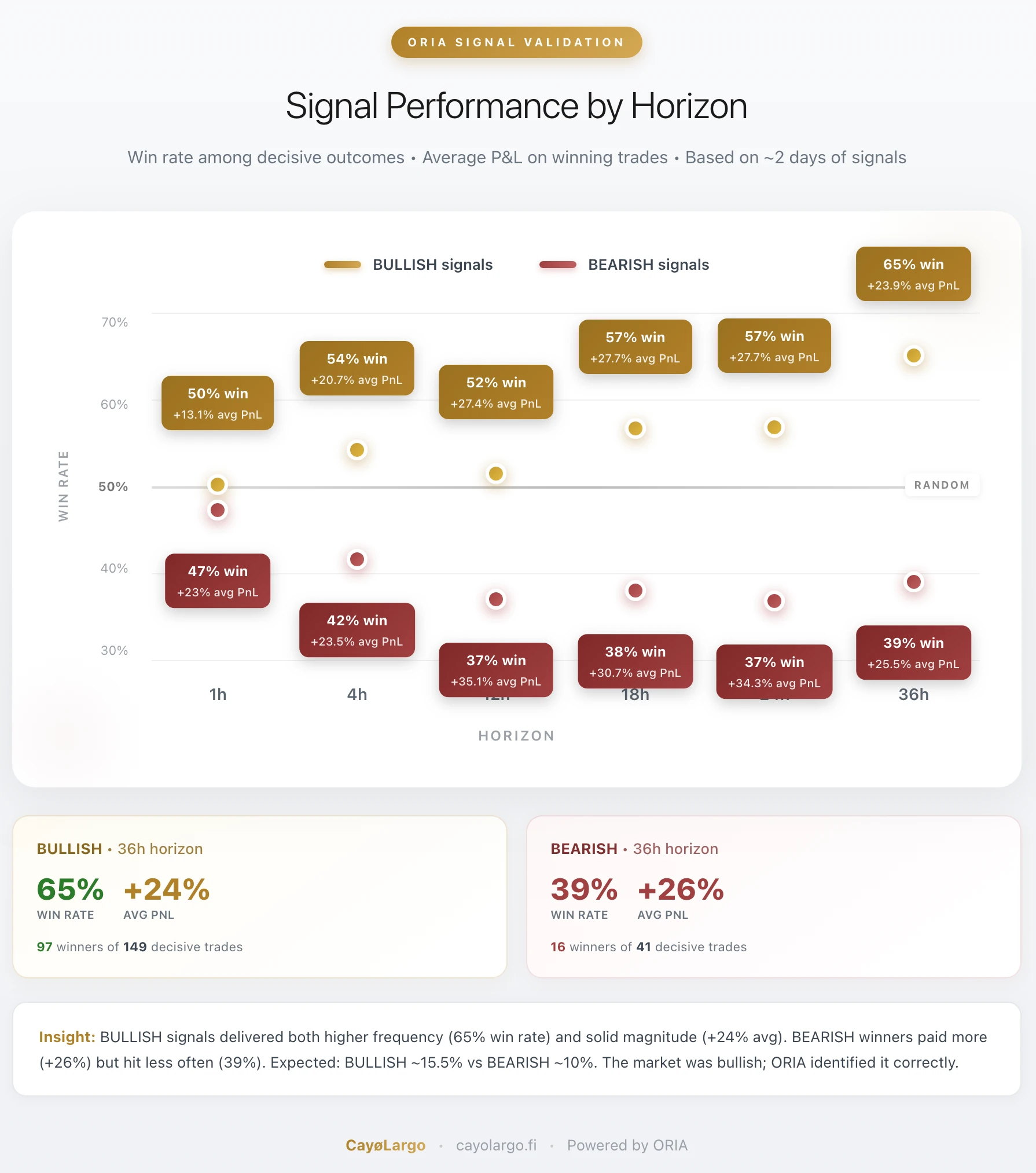

We ran 12,000+ option trades through ORIA's validation engine. BULLISH signals hit 65% at 36h with +24% P&L on winners. BEARISH? 39% win rate but +26% when they hit. Time lets the thesis play out.

Most crypto analytics tell you what happened. We wanted to know: did our signals predict what would happen?

So we ran 12,000+ option trades through ORIA's validation engine.

We start simple: every signal gets labeled BULLISH or BEARISH. We tracked whether instruments actually ended up profitable, excluding flat trades.

At the 36-hour horizon, BULLISH signals hit 65% of the time with +24% average P&L on winners.

BEARISH signals? 39% win rate. Below random.

But here's the interesting part: BEARISH winners averaged +26% when they hit. Classic contrarian payoff profile. Fewer wins, bigger magnitude.

The math still favors BULLISH. Expected return: 15.5% vs 10%.

Why?

The market was bullish over this period. ORIA's BULLISH signals captured it. BEARISH signals were correctly identified as fighting the trend.

One more thing: at shorter horizons, both signals hover near 50%. Noise dominates. But stretch to 24-36 hours and the divergence becomes clear.

That's how directional signals should behave. Time lets the thesis play out.

This isn't backtesting with hindsight. It's forward validation on live signals.

Halcyon Waters: Your Calmness Among Crypto Chaos