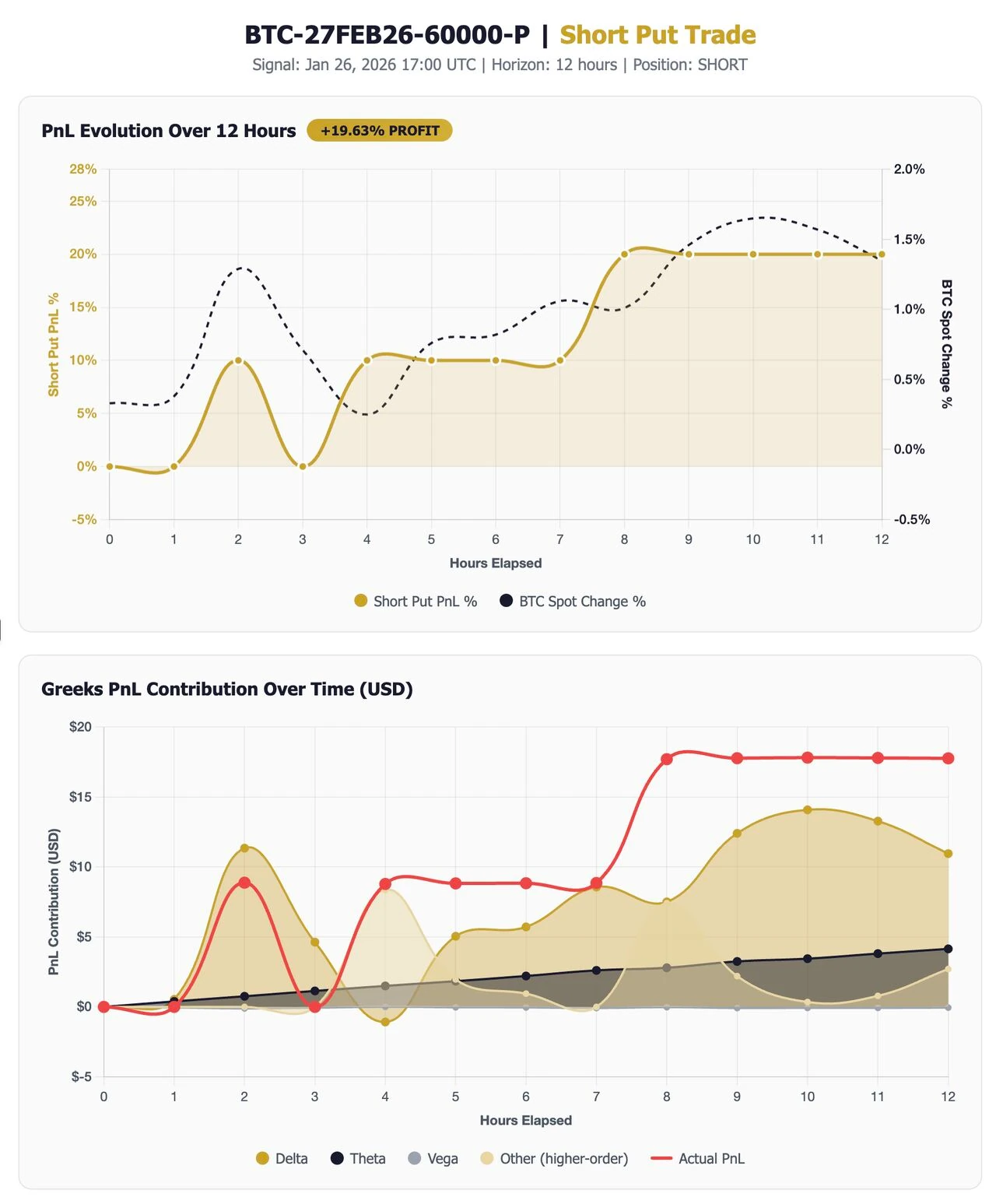

How We Validated a 19.6% Profitable Short Put with Real Slippage

Finding profitable options trades is one thing. Proving they're profitable after real-world costs is another. We broke down a BTC short put that returned +19.63% after empirical slippage from 48 hours of Deribit executions.

Finding profitable options trades is one thing. Proving they're profitable after real-world costs is another.

Here's how our ORIA signal validation system at Cayo Largo broke down a recent BTC put option trade.

The Setup:

Instrument: BTC-27FEB26-60000-P (Bitcoin put, $60K strike, Feb 27 expiry). Signal timestamp: January 26, 2026. Horizon: 12 hours. Implied position: SHORT (sell the put).

The Raw Move:

Entry mark price: 0.001 BTC ($87.65). Exit mark price: 0.0008 BTC ($70.78). Option price dropped 20%.

Direction Adjustment

This is where many backtests get it wrong. Our signal engine suggested shorting this put. When you're short and the price drops 20%, that's a 20% gain, not a loss. Direction-adjusted PnL: +20.00%.

Slippage Reality Check

We don't use arbitrary 5% or 10% slippage assumptions. We compute actual median slippage from 48 hours of Deribit trade executions.

Slippage source: COHORT level (DTE 31-90 bucket). Buy slippage: -0.0127% (tiny benefit). Sell slippage: -0.3805% (cost). Round-trip cost: 0.3678%.

Final Outcome:

Raw PnL: +20.00%. Realistic PnL: +19.63%. Outcome: PROFITABLE.

The 0.37% slippage pushed this trade just under the 20% threshold for "HIGHLY_PROFITABLE" but it remains solidly profitable.

Why This Signal Worked (Greeks Breakdown):

Delta drove 65% of the P&L. BTC spot rallied 60K put even further out-of-the-money. Theta added another 25% as 12 hours of time decay bled premium from a far OTM option. Vega contributed just 1% because IV barely moved (62.09% to 62.06%).

This wasn't a volatility play. It was a pure directional bet with time decay tailwind. The short put captured both.

The Real Lesson:

Small slippage matters. Even 0.37% can shift outcome classifications. But empirical slippage from real trades beats aggressive assumptions every time. A 5% blanket assumption would have shown this trade at +15% instead of +19.63%.

That's a 4.63% difference in perceived edge. Across hundreds of trades, that compounds into a completely different picture of strategy performance.

Build your validation systems on market reality, not assumptions.

Halcyon Waters: Your Calmness Among Crypto Chaos